Inflation taking bite out of lifestyle

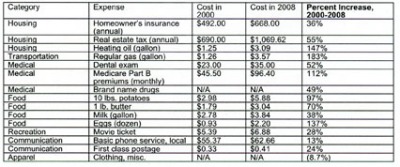

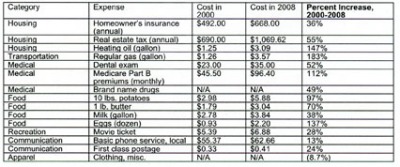

A senior with the average Social Security benefit in 2000 received $816 per month, a figure that rose to $1013.50 by 2008. However, that senior would require a Social Security benefit of $1,531.60 per month in 2008 just to maintain his or her 2000 lifestyle.

"Most Americans understand the impact higher gas and food prices are having on household budgets, but those increases are hitting seniors on fixed incomes hardest," said Daniel O'Connell, Chairman of The Senior Citizens League. "Our government is failing seniors year after year by giving them such a paltry Cost of Living Adjustment."

A 2007 analysis by The Senior Citizens League found that seniors had lost 40 percent of their buying power since 2000; this year's dramatic increase is largely a result of increasing food prices, transportation costs, and home heating oil rates.

A majority of the 37 million Americans aged 65 and over who receive a Social Security check depend on it for at least 50 percent of their total income, and one in three beneficiaries rely on it for 90 percent or more of their total income. In general, low-income seniors are most affected by the loss of buying power, since they have few other sources of income.

To help increase buying power and offset the cost of Medicare Part B, The Senior Citizens League is lobbying for a change in the Consumer Price Index (CPI) used to determine the COLA. The government currently calculates the COLA based on the CPI for Urban Wage Earners and Clerical Workers (CPI-W), a slow-rising index that tracks the spending habits of younger workers who don't spend as much of their income on health expenditures.

However, the government does track the spending patterns of older Americans, and has done so since 1983 with the CPI for Elderly Consumers, or CPI-E. By tying the annual increase in the COLA to the CPI-E, seniors would see much needed relief in their monthly checks.

For example, a senior who retired with a benefit of $460 in 1984 would have received $11,188 more over the past 24 years with the CPI-E.

TSCL supports two similar bills entitled "The Consumer Price Index for Elderly Consumers," introduced in the current Congress. H.R. 1953 was introduced by Representative Charles Gonzalez (D-TX), and H.R. 2032 was introduced by Representative Peter DeFazio (D-OR).

With 1.2 million supporters, The Senior Citizens League is one of the nation's largest nonpartisan seniors groups. Its mission is to promote and assist members and supporters, to educate and alert senior citizens about their rights and freedoms as U.S. Citizens, and to protect and defend the benefits senior citizens have earned and paid for. The Senior Citizens League is a proud affiliate of The Retired Enlisted Association. Visit www.SeniorsLeague.org for more information.